Spreads and margins

We offer competitive spreads across our full range of CFD markets, including shares, indices, forex, commodities and metals. Take advantage of 200:1 leverage and choose the account that’s right for you:

- Spread-only account

- Spread-and-commission account

Margin tiers

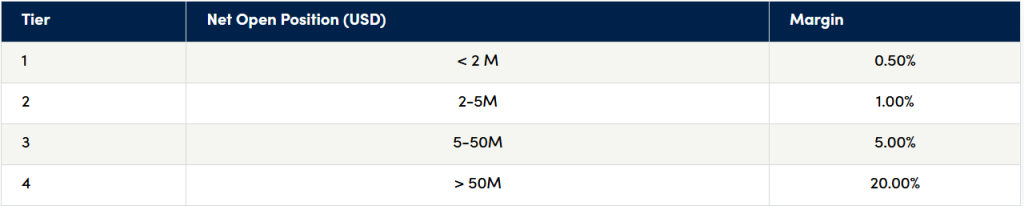

When an instrument has margin tiers, it generally means that the larger the position you hold over a certain size, the higher the applicable margin rate.

Different margin rates may apply depending on the size of your position, as your position size increases, so does the incremental margin rate on a tiered basis.

For example, on USD/JPY the margin rates are:

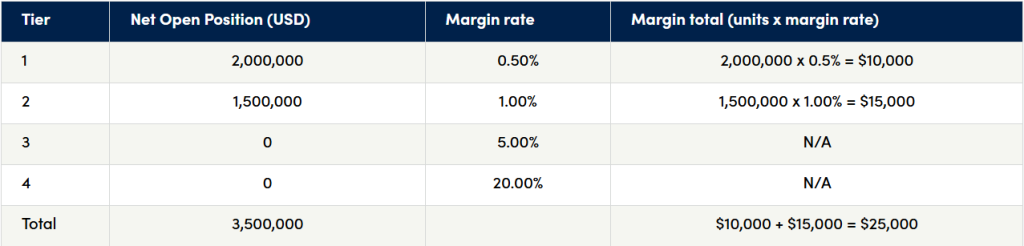

A position size of 3.5m USD/JPY would have a margin requirement of USD 25,000.

This is calculated as: (units in tier 1 x tier 1 margin rate) + (units in tier 2 x tier 2 margin rate) + (units in tier 3 x tier 3 margin rate).

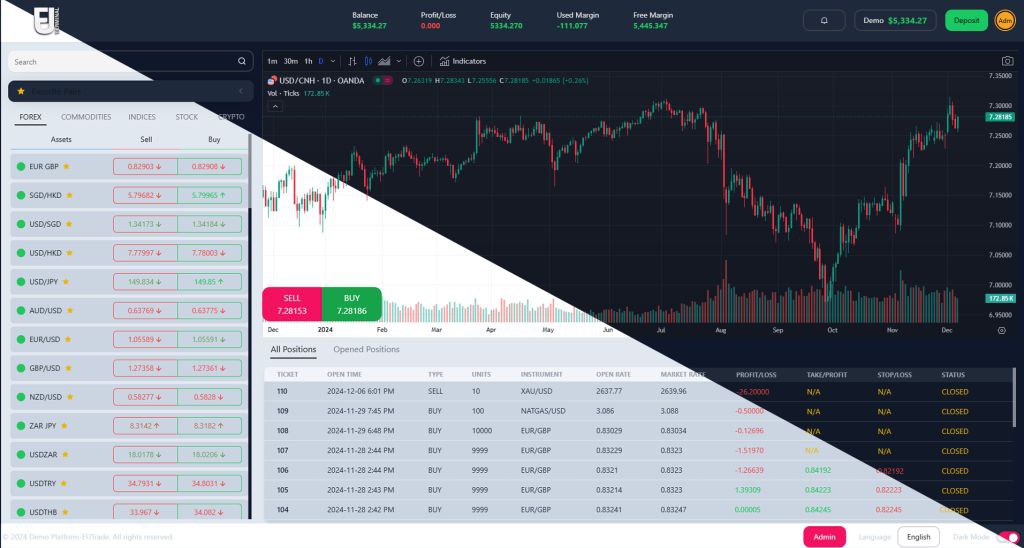

EUTRADE market rates in real time.

Different margin rates may apply depending on the size of your position, as your position size increases, so does the incremental margin rate on a tiered basis.

Margin trading

We offer clients the ability to trade with leverage. This means that you can enter into trades larger than your account balance and trade without depositing the full value of the trade that you wish to open. One of the benefits of trading with leverage is that you could potentially generate large profits relative to the amount invested. On the other hand, trading with leverage could also result in significant, rapid losses to your capital. Your losses can exceed the amount of your deposits.

We take a form of security (or deposit) against any losses you may incur when you trade

This collateral is typically referred to as margin.

The margin needed to open each trade is derived from the leverage limit associated with the size of the position and the instrument you wish to trade

Ready to start It's trading?

Open an account in minutes.

Create account

Already have a live trading account? It's easy to fund your account using one of the following payment methods.